[ad_1]

Economy

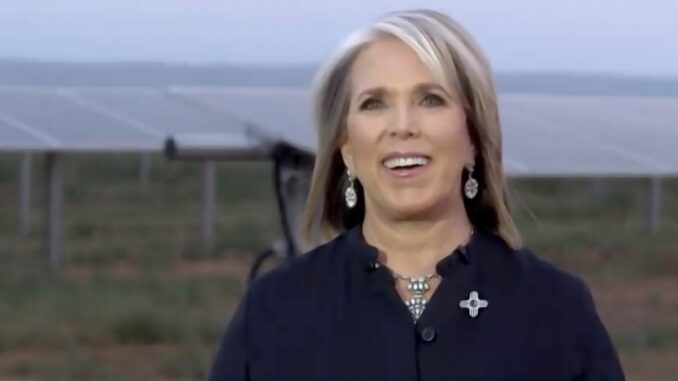

New Mexicans may soon get some extra money if a new proposal from Governor Michelle Lujan Grisham is approved. Gov. Lujan Grisham plans to give up to $1,500 in a new one-time tax rebate from New Mexico to about 875,000 taxpayers.

New One-Time Tax Rebate From New Mexico: Who Could Get It And When?

On Wednesday, Gov. Lujan Grisham endorsed a bill (Senate Bill 10) that includes sending a one-time tax rebate from New Mexico of $750 to single tax filers, or $1,500 to joint tax filers. This bill, which would deliver $1 billion in household relief to New Mexicans, has been sponsored by Senator Benny Shendo.

“This rebate will help thousands of families across the state as we continue recovering from the struggles we’ve faced these last few years,” Senator Shendo said in a statement.

The new one-time tax rebate from New Mexico would go to tax filers regardless of their income. However, to automatically receive the rebate money, taxpayers must have filed their 2021 tax return, says the draft of Senate Bill 10 posted online.

For those who don’t file taxes, the legislation recommends coming up with a system that would allow non-filers to apply for the rebate on a first-come, first-served basis. The authorities came up with a similar application system last year as well that allowed non-filers to apply through the New Mexico Human Services Department’s “Yes NM” website.

The bill doesn’t mention any specific date of when the rebates would be distributed, rather says that the rebates “shall be made as soon as practicable after a return is received.” However, once the proposal is approved, the Taxation and Revenue Department is expected to distribute the rebate money to eligible taxpayers this summer.

Not The First Time

Although Lujan Grisham has endorsed the bill, it still needs to be passed by both the New Mexico House and Senate. Neither of the chambers has taken a vote on the bill so far.

“As our state continues to see the results of our continued and targeted investments that have resulted in an unprecedented financial windfall, I look forward to working with the Legislature to put more money back in the pockets of New Mexico families,” Gov. Lujan Grisham said.

If the tax rebate is approved, it would be the second year in a row that lawmakers in New Mexico have pursued rebate legislation.

In 2021, New Mexico approved two rebate-related bills. The first bill sent $250 and $500 in rebate money in July to taxpayers meeting a specific income threshold, while the second bill sent $500 or $1,000 to taxpayers, irrespective of their income.

Along with this one-time tax rebate from New Mexico, Lujan Grisham is also working on reforming the state tax code to benefit working families and businesses. For the same, Lujan Grisham plans to reduce the gross receipts tax rate by a quarter of a percent, implement anti-pyramiding for professional services in the gross receipts tax rate, as well as deliver personal income tax progression.

This article originally appeared on ValueWalk

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Leave a Reply