<p> [ad_1]<br />

</p>

<div>

<div class="entry-content column content primary is-two-thirds">

<div class="" style="padding-bottom: 10px;">

<div class="">

<p>

<span class="tag is-dark is-uppercase">Investing</span>

</p>

<div class="byline-container">

<div class="post-date is-italic has-text-grey is-size-7 has-text-weight-medium ">

<p>February 16, 2023 1:33 pm</p>

</p></div>

</p></div>

</p></div>

</p></div>

</p></div>

<p>U.S. shareholder activists initiated 882 proxy campaigns in 2022, nearly a third more than were launched in 2021. Of those, 91 were settled before a vote was called. Just 17 proxy contests involving board nominees who were publicly opposed by the company went to a vote. In four of those contests, activists won at least one board seat. And among three proxy contests where an environmental or social demand was part of the campaign, one activist won a board seat.</p>

<p>The data was included in a report from shareholder activist data provider Insightia. In its Shareholder Activism Annual Review for 2023, released on February 15, Insightia acknowledged a tough 2022 but expects this year to be more successful.</p>

<p>To begin with, last September saw the beginning of a universal proxy voting card in the United States. Now, all candidates for a board seat will be listed on a single card. In years past, management-approved candidates were named on one card and dissident candidates were named on another. This SEC-mandated change is expected to improve the outcome of board elections by increasing the proportion of negotiated settlements or by electing dissident candidates. The SEC ruling also requires both sides to solicit at least 67% of shareholders.</p>

<p>The report cites J.P. Morgan’s head of shareholder engagement for Europe, the Middle East, and Africa: “I would expect to see more contested campaigns this annual meeting season compared to last. Activists have gone through the constructive approach, and some appear to be preparing their campaigns in a different way this year to at least provide themselves with increased optionality.”</p>

<p>Environmental, social and governance (ESG) activists launched 417 global campaigns in 2022, just 6.1% more than in 2021. Despite the increase, however, just 11.5% of environmental demands were at least partially successful, compared to 25.8% a year prior. This should be no surprise, given 2022’s tough macroeconomic environment.</p>

<section id="email-subscribe" class="section section-email-sub single-email-sub"><!-- div.svg-icon --></p>

<div class="container">

<div class="subscribe-message" style="line-height: 1.3;">

<p>Get Our Free Investment Newsletter</p>

</p></div>

</p></div>

</section>

<p>Insignia also named its 10 most influential activists for 2022. The firm picks its top 10 on the following points-based ranking method:</p>

<blockquote>

<p>[The] number of companies publicly subjected to activist demands, average market capitalization of targeted companies, success of public demands; average 2022 total follower return, and the depth of news coverage on the activist on Insightia One in 2022. To qualify, an investor must regularly employ an activist strategy and have publicly targeted three or more companies in 2022. The follower return reflects the gain or loss over the activist’s period of ownership of the stock. See Insightia’s report for a full definition.</p>

</blockquote>

<div class="recirc recirc-text">

<strong></p>

<p>				ALSO READ: Dividend Lovers Are Flying Into These ‘Strong Buy’ 7% or More Yielding Stocks<br />

</strong>

</div>

<p></p>

<p>Here’s the list:</p>

<h2>1. Elliott Management</h2>

<ul>

<li>Companies publicly subjected to demands: 9</li>

<li>Average target company market cap: $24.3 billion</li>

<li>Average 2022 total follower return: −2.3%</li>

<li>Insignia One news stories: 95</li>

</ul>

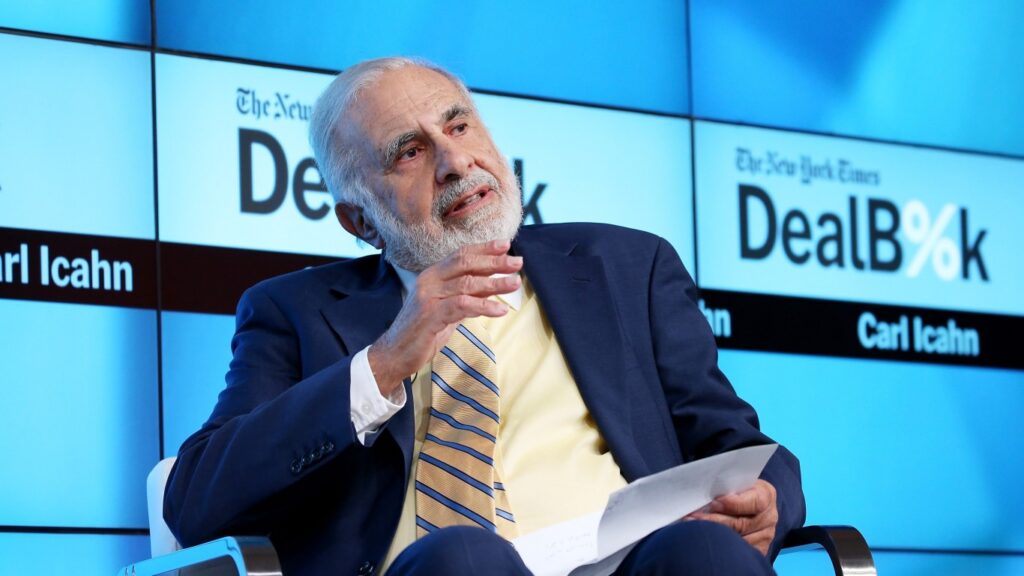

<h2>2. Carl Icahn</h2>

<ul>

<li>Companies publicly subjected to demands: 7</li>

<li>Average target company market cap: $39.7 billion</li>

<li>Average 2022 total follower return: −3.93%</li>

<li>Insignia One news stories: 61</li>

</ul>

<h2>3. Saba Capital Management</h2>

<ul>

<li>Companies publicly subjected to demands: 8</li>

<li>Average target company market cap: $284.4 million</li>

<li>Average 2022 total follower return: 8.67%</li>

<li>Insignia One news stories: 22</li>

</ul>

<h2>4. Ancora Advisors</h2>

<ul>

<li>Companies publicly subjected to demands: 10</li>

<li>Average target company market cap: $4.2 billion</li>

<li>Average 2022 total follower return: −14.65%</li>

<li>Insignia One news stories: 47</li>

</ul>

<h2>5. Nippon Active Value Fund</h2>

<ul>

<li>Companies publicly subjected to demands: 13</li>

<li>Average target company market cap: $335 million</li>

<li>Average 2022 total follower return: 7.42%</li>

<li>Insignia One news stories: 7</li>

</ul>

<h2>6. Crystal Amber</h2>

<ul>

<li>Companies publicly subjected to demands: 3</li>

<li>Average target company market cap: $139.5 million</li>

<li>Average 2022 total follower return: 27.93%</li>

<li>Insignia One news stories: 12</li>

</ul>

<h2>7. Value Act Capital Partners</h2>

<ul>

<li>Companies publicly subjected to demands: 4</li>

<li>Average target company market cap: $29 billion</li>

<li>Average 2022 total follower return: −0.97%</li>

<li>Insignia One news stories: 20</li>

</ul>

<h2>8. Jana Partners</h2>

<ul>

<li>Companies publicly subjected to demands: 4</li>

<li>Average target company market cap: $4.8 billion</li>

<li>Average 2022 total follower return: 0.66%</li>

<li>Insignia One news stories: 40</li>

</ul>

<h2>9. Engine Capital</h2>

<ul>

<li>Companies publicly subjected to demands: 6</li>

<li>Average target company market cap: $2.6 billion</li>

<li>Average 2022 total follower return: 3.40%</li>

<li>Insignia One news stories: 16</li>

</ul>

<h2>10. Starboard Value</h2>

<ul>

<li>Companies publicly subjected to demands: 5</li>

<li>Average target company market cap: $14.5 billion</li>

<li>Average 2022 total follower return: −20.12%</li>

<li>Insignia One news stories: 15</li>

</ul>

<p>				<!-- #post-footer--></p></div>

The 10 Most Influential Activist Investors of 2022 – Darlinez News.